Interested in The Safe Harbor Course?

Avoid Tax Surprises. Learn How to Pay Estimated Taxes with Confidence.

Join the waitlist for the Safe Harbor Mini-Course—your shortcut to IRS-proof quarterly payments without the stress.

Education

〰️

Experience

〰️

Education

〰️

Education 〰️ Experience 〰️ Education 〰️

📽️ What You’ll Learn

What You’ll Master in Just 30 Minutes:

✅ What Safe Harbor is and how it protects you from IRS penalties

✅ The three Safe Harbor rules—and which one’s right for your business

✅ How to calculate and make your quarterly estimated tax payments

✅ Tools to stay organized and ahead of deadlines

🗣️ This course is built for busy service providers—no fluff, no jargon, just what you need to stay penalty-free.

🧰 What You’ll Get

Included in the Mini-Course:

🎥 30-Minute Step-by-Step Video

📊 Safe Harbor Calculator (plug-and-play)

📅 IRS Deadline Calendar (import to Google or iCal)

📥 PDF Downloads & Quick Reference Guides

🎁 Bonus: “Ask Your Accountant” Email Script

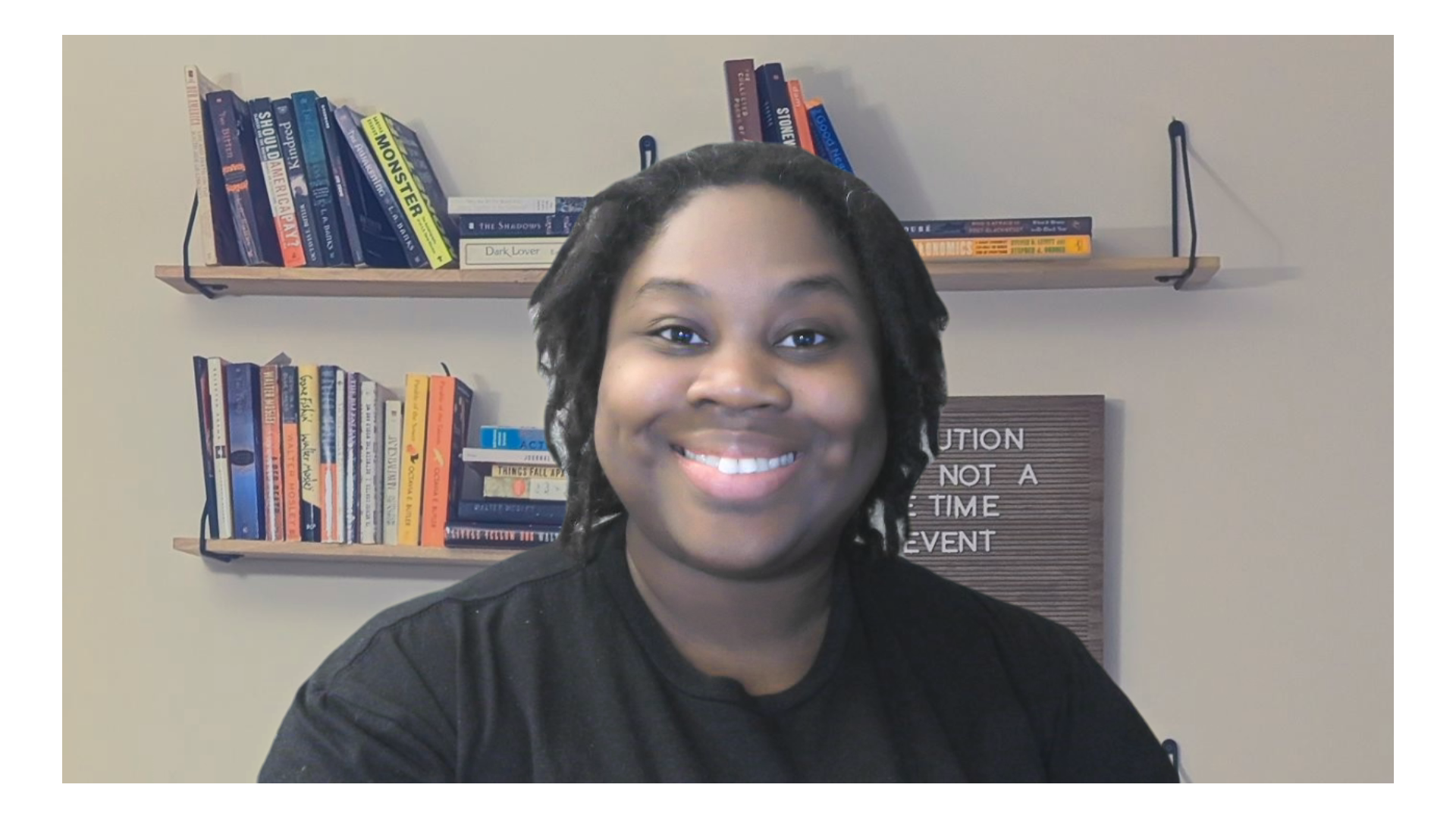

Hi, I’m Marian 👋🏽

I’m a fractional CFO, tax strategist, and the founder of Nirvana Business Consulting. I help service-based entrepreneurs understand their numbers and simplify their tax game.

This mini-course was born from hundreds of client conversations where the #1 stressor was taxes. I made this to give you clarity, confidence—and compliance—all in under an hour.

This Is Perfect For You If You...